Companies often prefer to offshore their accounting tasks to an external accounting firm.

Why?

In-house accounting services can often be overly expensive due to hiring and training costs and require too much management oversight. But with offshore accounting services, you get high-quality services at affordable prices due to the low labor costs in popular offshoring destinations like India, Mexico, etc.

In this article, we’ll take a look at what offshore accounting is and the types of offshore accounting services. We’ll also delve into the benefits and drawbacks of offshoring accounting tasks to other countries.

Lastly, we’ll mention some of the top offshore accounting service providers.

Table of Contents

Let’s get started.

What services does offshore accounting include?

Offshore accounting involves assigning accounting and financial operations to an offshore service provider.

Accounting is one of the core business activities in any company. You must maintain the financial records to manage the budgets, comply with regulations, and learn about your company’s financial viability.

While most businesses have an in-house accounting department, many companies choose to delegate such tasks to low-cost countries such as India or the Philippines.

So, how can offshore accounting service providers help you?

An offshore accounting firm can assist you with services like:

1. Bookkeeping services

The bookkeeping service enables you to record, classify, and organize the financial transactions of your firm. Through this service, you can access past financial statements that can help you draft future business plans or attract investors.

2. Tax preparation

Tax preparation involves preparing, calculating, and filing employment tax, excise tax, and income tax returns. A tax return is a document you need to submit to the government that declares relevant calculations with proof. Tax preparation services can also help you with international tax compliance so you can avoid charges related to tax evasion.

3. Financial statement preparation

This includes creating a balance sheet, income statement, and retained earnings statement, along with monitoring the company’s cash flow. Financial statement preparation can help you evaluate the liquidity of your business.

4. Account receivable and payable services

Accounts receivable is the amount of money that your customers owe you. And accounts payable is the amount of money you owe to a seller or a vendor. This service lets you identify and reach out to clients who haven’t paid their invoices on time.

5. Payroll services

Payroll services include calculating your employee’s salaries and applicable tax, printing and delivering checks, etc. Payroll services can help you maintain precise records of employee salaries and cash flows, which often gets complicated as your team gets bigger.

6. Year-end accounting

Year-ending accounting involves gathering financial statements and past due invoices, organizing business receipts, cross-checking payroll and bookkeeping, etc., at the end of a financial year.

These tasks require a lot of skill and may be costly in countries like the US, UK, etc. However, offshoring firms can provide the same services at a fraction of the cost.

There are several benefits of outsourcing your accounting services to an offshore company. In the next section, we’ll take a look at some of them.

6 key benefits of offshore accounting or businesses

Offshore accounting services can help your business gain a competitive advantage.

Here’s how:

1. Increases profitability

The cost of paying your offshore employees is less than what you pay to your in-house employees. This is especially true if you have offshore employees in countries with a comparatively low average salary.

For example, the average salary of an accountant in India is 10,644 USD per year (salaryexplorer.com), while that of an accountant in the Philippines is 4,407 USD per year. This is comparatively lower than the average salaries in the US (57,899 USD – Indeed.com) or the UK (44,170 USD).

So European and North American companies can increase cost savings if they offshore to a third-party accounting firm. They don’t have to pay for their full-time offshore employees’ accommodation, transport costs, or sick pay allowances.

2. High quality of services

Offshore accounting firms only focus on accounting services. This implies that such teams will deliver high-quality services since they are specialists and have extensive knowledge in their field.

Additionally, if an offshore accounting firm has multiple clients, its employees receive frequent feedback to improve their skill set. That’s why working with a firm that has a diverse and robust portfolio of clients will benefit your business directly.

By offshoring the accounting tasks to an external service provider, business owners don’t need to look after time-consuming tasks like financial reporting, bookkeeping, tax compliance, auditing, etc. They can be assured that the offshore accounting firm will deliver the best service.

3. Saves time on recruitment

Hiring an in-house accountant can involve things like putting out a job advertisement, conducting interviews, training, and more.

Additionally, onboarding the new employee may involve processes like coordinating with other departments, organizing orientation, etc. This may delay the completion of other major tasks with actual deadlines from the client.

By offshoring your accounting functions, you won’t have to spend any time on hiring or training since your offshoring team will handle that.

4. Access to a vast talent pool

With offshoring, you have the freedom to hire talent with high expertise, someone who can fulfill your specific work requirements.

For example, popular offshoring destinations like India, China, and Brazil have a reputation for providing top-class offshore services to companies in Europe and North America. These countries also provide accounting experts who have graduated from top financial institutions.

Companies can offshore their accounting operations to these countries and benefit from accountants’ expertise in bookkeeping, bank flow statements, balance sheets, etc.

5. Improves operational flexibility

With the help of an offshoring partner, your business can offer round-the-clock services. This is due to time zone differences among partner countries, which lead to different working hours for your in-house and offshore employees.

Moreover, you don’t need to offshore every accounting process all at once.

Initially, you can offshore only those tasks that may be difficult or costly to operate in-house. Once you’ve figured out a comfortable pace and style of working with the offshore vendor, you can outsource the remaining services too. This cost-effective strategy can help ambitious small businesses to scale up and down with ease.

6. Maintains confidentiality

You can rest assured that your information is held with great care, by offshoring accounting and bookkeeping functions to globally qualified chartered accountants.

In an offshore team setup, most of the work, like transferring accounting data and recording data, is done online. And that’s why data breach is one of the primary concerns for many business owners looking to offshore their company’s accounting function.

However, many offshore companies have a dedicated cybersecurity channel and a complete in-house data security team. They are capable of fully safeguarding your financial information and maintaining confidentiality.

Now let’s take a look at some of the drawbacks of offshoring accounting tasks to a foreign country.

4 potential drawbacks of offshore accounting services for businesses

Here are some major limitations of offshoring your accounting needs to an external service provider.

1. Communication issues

Global organizations typically communicate in English. However, not all offshoring destinations, like China or Vietnam, have a fluent English-speaking population.

So it may happen that your offshore team is unable to understand the work brief properly. Such a scenario can cause work delays, internal conflicts, higher project costs, dissatisfaction amongst clients, and low employee morale.

To avoid such miscommunication, offshore teams should hire multilingual staff who can clearly communicate with their global clients.

2. Different time zones

Time zone differences can be a double-edged sword for companies looking to offshore their accounting services.

For one thing, you can get round-the-clock services from offshoring companies. However, it can be difficult to bring the whole team together during an urgent team meeting or business emergency as their working hours will differ.

For example, the time difference between India and the USA is approximately 12 hours. This makes it extremely challenging for both sides to work simultaneously or brainstorm over a problem together.

3. Complicated tax compliance

Every country has its own set of tax laws and reporting regulations that you must take into account before choosing an offshore service provider.

For instance, while offshoring to a foreign country, US companies need to file an FBAR (Foreign Bank Account Report) for an aggregate value of USD 10,000 in their offshore bank account at any time in the year.

Additionally, the IRS (Internal Revenue Service) developed the OVDP (Offshore Voluntary Disclosure Program) for US taxpayers to disclose previously unreported offshore assets in offshore financial centers. The IRS audits suspicious accounts that try to get away with offshore tax evasion.

The Pandora Papers, released in 2021, consisted of nearly 12 million leaked documents. It revealed the illegal offshore interests of prominent world leaders, corporate executives, politicians, billionaires, and celebrities.

Additionally, offshore countries have their own tax and other enforceable laws for the parent companies. For example, Mexican labor law has made it mandatory for offshoring and outsourcing companies to share 10% of their business profits with their employees.

So, how can you avoid a visit from the tax authorities?

Before you decide to offshore, ensure that you meet your country’s legal requirements and also those of the offshore jurisdiction. Hire a tax law expert in the offshore country to navigate tricky compliance formalities.

4. Difficulty In assessing productivity

It’s extremely tough to check the efficiency of your offshore accountant if they’re working in a different country and time zone.

After all, how do you know if they’re logging in for the required number of hours every workday?

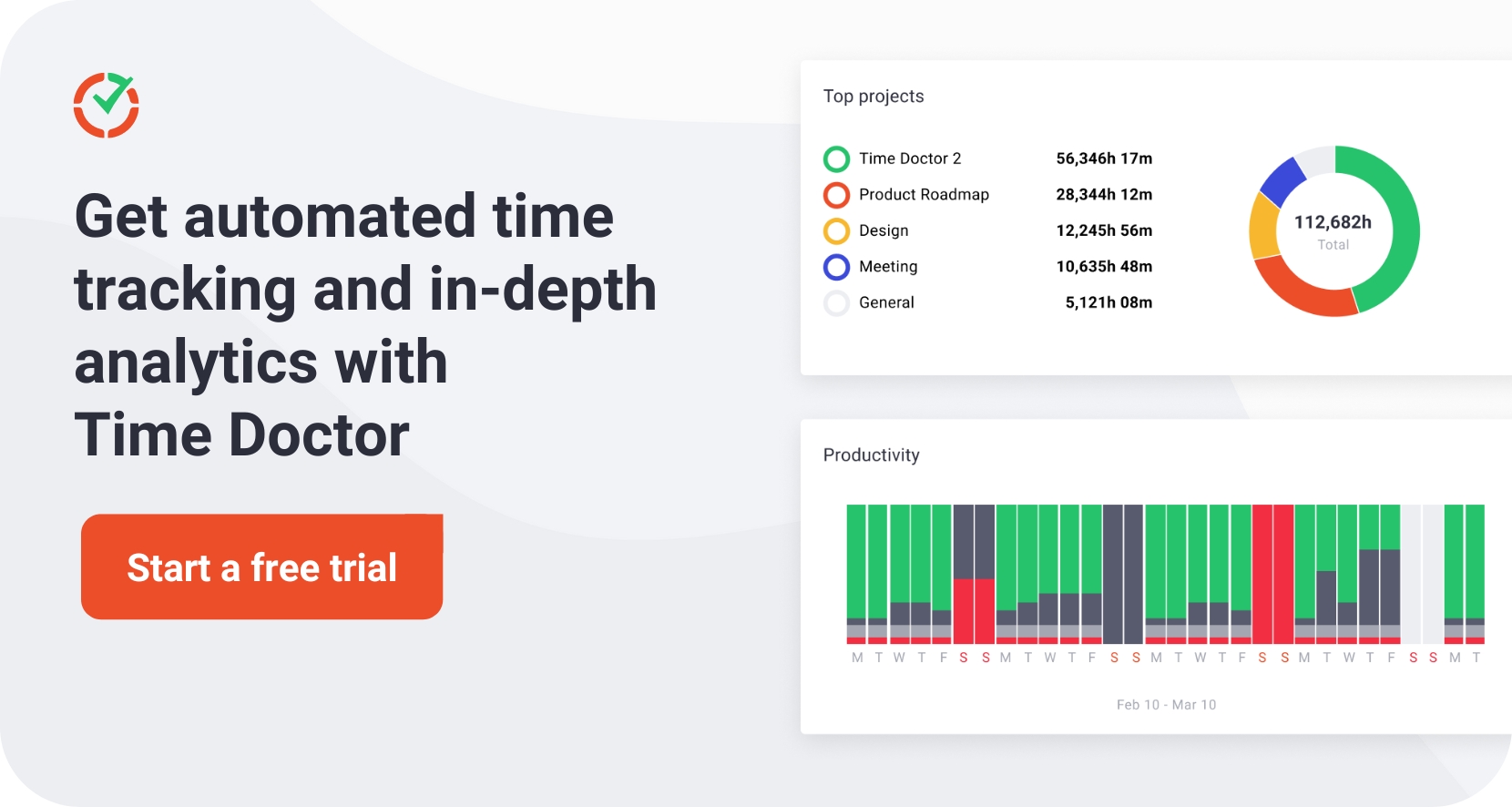

Fortunately, you can use a feature-rich time tracking solution such as Time Doctor.

Here are some ways in which you can benefit from a time tracking app like Time Doctor:

Read about Time Doctor’s features in detail to elevate your team’s productivity.

Next, we’ll explore some offshore accounting service providers.

4 popular offshore accounting service providers

In this section, we’ll mention some top service providers who can take care of your accounting needs.

1. Offshore business processing

Offshore Business Processing is a Philippines-based BPO (Business Process Outsourcing) company providing accounting, call centers, and IT services. It offers bookkeeping, tax preparation, accounting, internal auditing, etc., to both large and small businesses.

Key features

- Provides data-entry specialists with a high level of English proficiency.

- Offers real-time reports of your bookkeeping records.

- Provides solutions for complex tasks such as tax records and financial statement preparation.

2. BMC SAAS

BMC Support & Accounting Services Pvt. Ltd. (BMC SAAS) is an offshore company situated in India that can help you with payroll preparation, financial accounting, taxation, and many other financial services.

Key features

- Provides bookkeeping services to medium as well as small-sized businesses.

- Helps you manage your business’s payroll in an accurate and timely manner.

- Offers A/P (Accounts Payable Aging) and A/R (Accounts Reports Aging) reports that reflect your company’s financial performance.

3. FinTax Experts India

FinTax Experts India helps SMEs with offshore bookkeeping services, accounting solutions, and tax preparation services. The company is headquartered in India and is based in multiple locations like the USA, UK, Australia, and Canada.

Key features

- Employs skilled executives with several years of experience in finance, banking, and IT.

- Employees are trained to use accounting and tax software used in the USA, UK, Canada, and Australia.

- Uses 128-bit secure socket layer encryption for data transfer when the client doesn’t prefer VPN (Virtual Private Network) access.

4. Hammerjack

Hammerjack is a Philippines-based company that provides accounting experts to clients. This accounting firm has global clients like General Electric, American Express, AT&T Inc, and many more.

Key features

- Generates reports and financial statements in real-time.

- Offers customized accounting services according to your business needs.

- Uses cloud technology to safely backup your accounting data.

Wrapping up

Many small and medium-sized businesses are opting to offshore accounting tasks and maximize business profitability.

However, when you offshore accounting to a CPA (Certified Public Accountant) or any other CPA firm, you must ensure that they fit your unique business requirements.

You can go through the pros and cons discussed in this article to decide whether offshore accounting is suitable for your business.

Andy is a technology & marketing leader who has delivered award-winning and world-first experiences.